Tech giants such as Amazon, Google and Facebook will be forced to pay tax on sales they generate in the UK under plans announced in yesterday’s Budget.

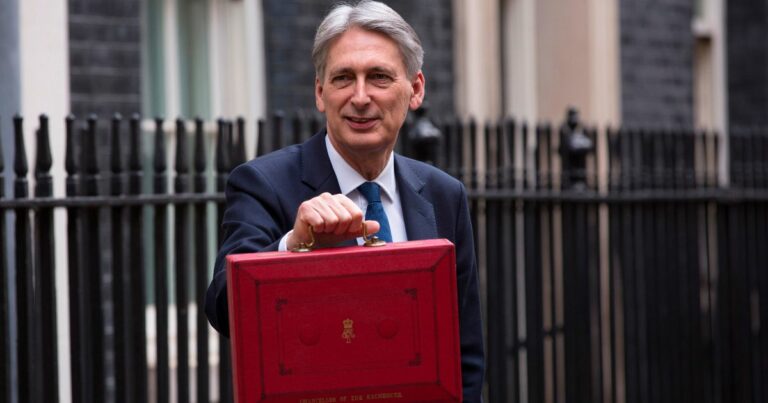

Chancellor Philip Hammond is proposing a 2% tax rate against the sales that social media platforms, internet marketplaces and search engines make in the UK.

He said the tax would be imposed on companies that were profitable and generated “at least £500m a year in global revenue”.

Although he did not name them, the tax is being seen as a way for the Treasury to address criticism about the amount of tax paid by the likes of Google, Amazon – who recently announced the opening of a new 600-strong Manchester office – and Facebook in the UK.

He said: “It is clearly not sustainable or fair that digital platform businesses can generate substantial value in the UK without paying tax here.”

The digital services tax is set to be introduced from April 2020 with hopes it could bring in £400m in 2021-22 and £440m the year after.

Elsewhere in the Budget, Hammond extended a business rate cut scheme for local newspapers.

The scheme, which offers a discount of £1,500 per office in England in an attempt to encourage local press back into town centres, for a further year.

Hammond joked that the news would assure him a “warm welcome in the Royston Crow and the Keswick Reminder”.