Schroders Capital has agreed a £20m partnership with Manchester-based EV charging network Be.EV which will see more than 200 ultra-rapid EV charging bays installed across 22 Schroders Capital-managed retail and leisure properties across the UK.

The £20 million investment will see Be.EV fully fund the installation and maintenance of state-of-the-art charging solutions at sites managed by five Schroders Capital real estate funds, including Schroder Real Estate Investment Trust and Schroders Capital UK Real Estate Fund, enhancing key retail destinations nationwide.

Be.EV will install ultra-rapid Kempower chargers, capable of delivering up to 325 miles of range in as little as 20 minutes, on some of the UK’s most prominent retail and leisure parks, where retailers include Sainsburys, Aldi, Lidl, Costa Coffee, KFC, McDonalds, Nandos, Pizza Express, Starbucks, Marks & Spencer and IKEA.

Be.EV is majority-owned by Octopus Energy Generation’s £1.5 billion Sky Fund, which has pledged £110 million of funding, positioning Be.EV as one of the UK’s most stable and well-backed charge point operators.

READ MORE: Mr Bates, Baby Reindeer, Clive Myrie fly the flag for the North at TV BAFTAs

The new chargers are expected to have a significant positive financial impact on Schroders Capital’s occupiers. A survey last year found 57% of drivers who use a public charger will go shopping or visit a cafe while charging their vehicle. These benefits to retailers are only going to grow, with registrations of new EVs expected to grow by 31% in 2025.

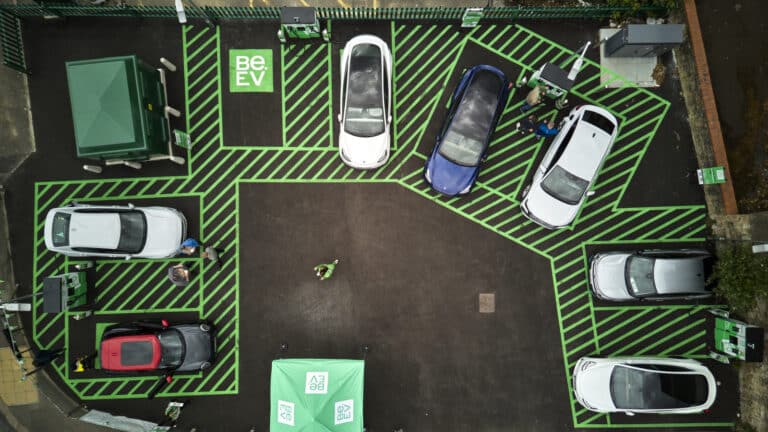

The charging hubs, the majority featuring six to 12 charging bays, will be leased on a 20-year agreement with index-linked market rents, reflecting the commitment from both Schroders Capital and Be.EV to sustainable infrastructure development.

The partnership cements Be.EV’s position as a leading, nationwide charge point operator, supporting landlords in future-proofing their assets by bringing convenient, ultra-rapid charging to their shoppers. In return, Schroders Capital clients benefit from long-term, index-linked income stream.

Legal agreements have been exchanged on the first three locations, with further exchanges expected imminently.

Asif Ghafoor, CEO of Be.EV, said: “Like the thousands of drivers who use our network each day, Be.EV is going places.

“This is a landmark deal for Be.EV and we are excited to help the big brands who occupy the retail parks in Schroders portfolio benefit from the increased footfall benefits EV charging brings.

“I would like to congratulate all the team at Be.EV for their hard work in securing this important deal.”

Matthew Baddeley, lead asset manager at Schroders Capital, added: “Improving the UK electric charging network is essential in supporting the UK’s energy transition goals, whilst it also aligns with our own net zero targets. Be.EV’s offering is highly compelling and we look forward to welcoming them to the Schroders Capital’s retail warehouse portfolio.”